Why more Americans are on the move

While many are choosing to move from high- to low-tax states, soon there may be nowhere left to escape to.

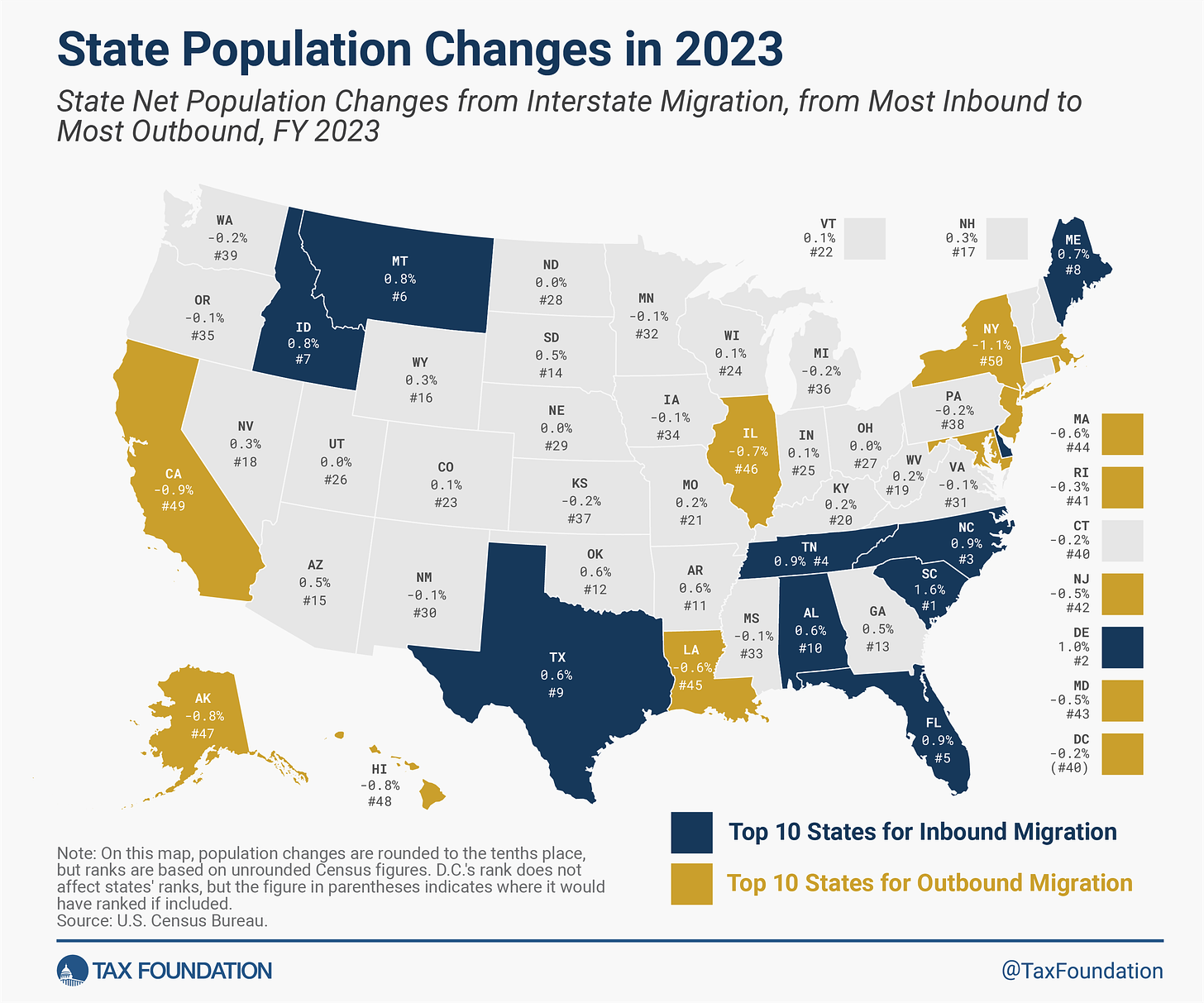

Last week, U-Haul released its Top Growth States 2023 report, which shows the top destinations for do-it-yourself movers. No surprise, the Lone Star State was number one, with Florida a close second:

DIY movers arriving in Texas accounted for 50.4% of all one-way U-Haul traffic in and out of Texas (49.6% departures) to keep it the leading growth state. Florida remains equally appealing to new residents, netting almost as many one-way U-Haul customers as Texas in 2023.

Both have no state income tax, which admittedly is a simple explanation for the influx. But it’s certainly compelling.

Of course, with winners come losers. And not surprisingly, California, Massachusetts, Illinois, New Jersey, and Michigan — which all have high taxes — had the smallest influx of one-way rentals, according to the report.

What can be made of these numbers?

A small vignette from Ernest Hemingway’s 1926 novel The Sun Also Rises does the trick perfectly:

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

California is a great example in this case (but it could easily be New Jersey or any of the others). What’s happening is fewer and fewer taxpayers are footing the bill for more and more services and handouts. Or, put another way – as our friend Peter Grandich describes it – more people are climbing into the wagon, and fewer are pulling it.

It doesn’t take long before the people pulling either give up and jump in the wagon themselves, or go elsewhere, where the wagon is lighter and their pulling is respected and valued. This movement is a mathematical function that grows exponentially, so the “gradually” gives way to the “suddenly” quite quickly.

But don’t underestimate the ability of governments to get clever with how they plug the fiscal nightmare of their own making. And, as California goes, so goes the rest of the nation. From the Wall Street Journal regarding the imposition of a proposed new wealth tax in the Golden State:

The bill would impose an annual excise tax of 1.5% on the worldwide net worth of every full- and part-year California resident that exceeds $1 billion, starting this tax year. Come Jan. 1, 2026, the state would tax wealth that exceeds $50 million at a rate of 1% each year, with an additional 0.5% tax on assets valued at more than $1 billion.

Part-time residents would be taxed on a pro rata share of their wealth based on the number of days they spend annually in California. The tax would also apply to nonresidents who have recently left the state. You can check out of the state, but you would still have to pay California’s wealth tax if you do.

That last sentence is critical to understand. If California gets its way, there will be no escaping the long arm of the government — you will pay your feudal master. Of course, this will be challenged in courts and likely struck down, but the mentality that underpins this attempt is what all lovers of freedom and liberty must guard against. Because, if the Jacobins and Bolsheviks get their way, your wallet and its contents are no longer yours no matter where you go.

Understand also that taxation as an alternative to fiscal responsibility is a cancer on a free society. When people begin to see with clear eyes that it’s not just the wealthy, but that everyone is a target, they’ll begin to understand what underpinned Hemingway’s dialogue.